Understand the Stochastic Oscillator Indicator

Technical analysis gives traders tools to understand the market. The Stochastic Oscillator is a key tool for finding hidden signals. It was created in the 1950s to help investors see price changes and when trends might change.

Traders see the Stochastic Oscillator as a tool that moves between 0 and 100. It helps spot when the market is too high or too low. This lets traders know when to buy or sell.

Even though 69% of retail investors find trading hard, knowing the Stochastic Oscillator helps. It shows how the market is moving and when it might change. This helps traders make better choices.

This guide will show how the Stochastic Oscillator works. It helps traders turn complex ideas into clear plans. Knowing this tool well can change how traders see the market and make decisions.

What is the Stochastic Oscillator Indicator?

The world of technical analysis has many tools for traders. The stochastic oscillator is a key momentum indicator. It helps investors understand market dynamics.

Dr. George Lane created the stochastic oscillator in the late 1950s. It’s a tool for measuring market momentum. It compares a security’s closing price to its price range over time.

Core Principles of the Indicator

The stochastic oscillator works on a few main principles:

- It measures price momentum by comparing closing prices

- It tracks price movement within a defined range

- It helps predict price reversals

- It uses a 0 to 100 scale

Historical Development

Lane’s work was a big change in technical analysis. He thought momentum changes before price direction shifts. This made the stochastic oscillator a predictive tool for traders.

The indicator uses 14 time periods by default. You can adjust it for hourly or daily charts. It shows when the market might turn by highlighting overbought and oversold conditions.

Unique Characteristics

- Readings at 0 show the lowest trading range point

- Readings at 100 show the highest trading range point

- Crossovers and divergences signal trade opportunities

Traders like the stochastic oscillator for its detailed market insights. It’s a key tool in technical trading strategies.

How the Stochastic Oscillator Works

Trading experts use the stochastic oscillator to see market trends and price changes. This tool helps them find important trading signals by looking at price changes.

The stochastic oscillator uses a detailed math method to track price changes. It creates two main lines: %K and %D lines for traders.

Key Calculation Components

Stochastic oscillator calculations have key parts:

- Uses a 14-period price range

- Compares current closing price to recent prices

- Shows values from 0 to 100

Understanding %K and %D Lines

The %K line shows the raw stochastic value. It compares the current closing price to recent prices. The %D line is a 3-period moving average of the %K line. It gives a clearer view of market momentum.

Calculation Formula Breakdown

The main formula is: %K = 100 * (Current Close – Lowest Low) / (Highest High – Lowest Low). This formula shows the current price’s position in its recent range.

- Values above 80 mean the price might be too high

- Values below 20 mean the price might be too low

Traders look at these %K and %D lines to find trend changes, momentum shifts, and trading chances in different markets.

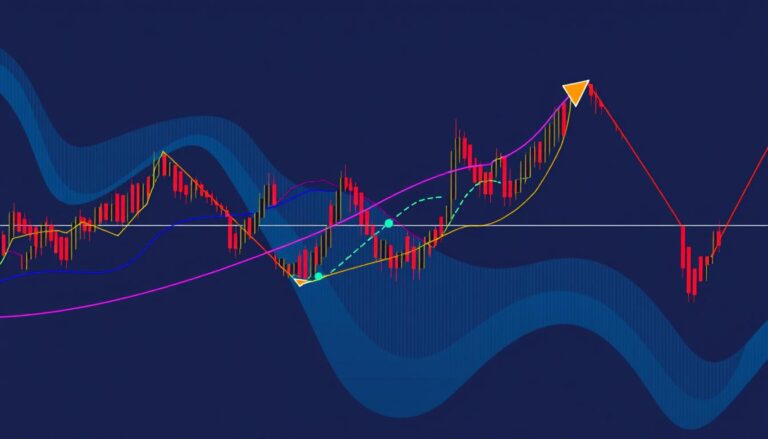

Reading Stochastic Oscillator Signals

Trading experts use the stochastic oscillator to understand market trends. It shows when trends might change. This tool is key for spotting important price movements.

- Overbought and oversold conditions

- Stochastic divergences

- Crossover signals

Understanding Overbought and Oversold Conditions

The stochastic oscillator helps spot when prices might turn around. It uses two main zones:

- Overbought zone: Values above 80

- Oversold zone: Values below 20

But, strong trends can keep prices in these zones for a long time. Traders need to be careful.

Exploring Stochastic Divergences

Stochastic divergences are key for spotting trend changes. There are two main types:

- Bullish divergence: Price makes a lower low, but the oscillator forms a higher low

- Bearish divergence: Price creates a higher high, while the oscillator forms a lower high

These divergences show when momentum might change. They help traders know when to buy or sell.

Setting Up the Stochastic Oscillator

Setting up the stochastic oscillator is key for good trading. Traders have many options for this tool. Each choice affects the trading signals they get.

The stochastic parameters let traders pick their approach. They can choose from different setups:

- Standard 14-period setting for balanced analysis

- Short-term 5-3-3 configuration for rapid signals

- Long-term 21-7-7 setting for smoother trend identification

Choosing Parameters for Trading

Choosing the right settings depends on your trading style. Short-term traders like lower settings for quick signals. Long-term investors prefer higher periods to smooth out market noise.

Common Settings for Different Markets

Market types affect the best stochastic settings. Day traders might use 5-3-3 for fast signals. Swing traders might choose 14-3-3 or 21-5-5 for better trends.

- Forex markets: Often use 14-3-3 or 8-3-3 settings

- Stock markets: Typically prefer 14-3-3 or 21-5-5

- Cryptocurrency markets: May require more adaptive settings

Traders should try different settings and test them. This helps find the best fit for their strategy and market.

Using the Stochastic Oscillator in Trading Strategies

Traders use the stochastic oscillator in many ways. They create smart plans to find good trading chances. This tool helps see price changes and when markets might turn around.

To trade well with the stochastic oscillator, you need to know two main strategies:

Trend Following Strategies

Trend following uses the stochastic oscillator to spot market trends. Traders look for certain things:

- They watch the indicator during strong trends

- They see how %K and %D lines move

- They find long periods of being too high or too low

Reversal Trading Techniques

Reversal trading looks for when prices might change direction. Important steps include:

- They check when price and oscillator don’t match

- They watch when lines cross in overbought or oversold areas

- They find hidden signals of big changes

Traders can make their strategy better by mixing these methods. They watch the market closely and use other tools to check their signals.

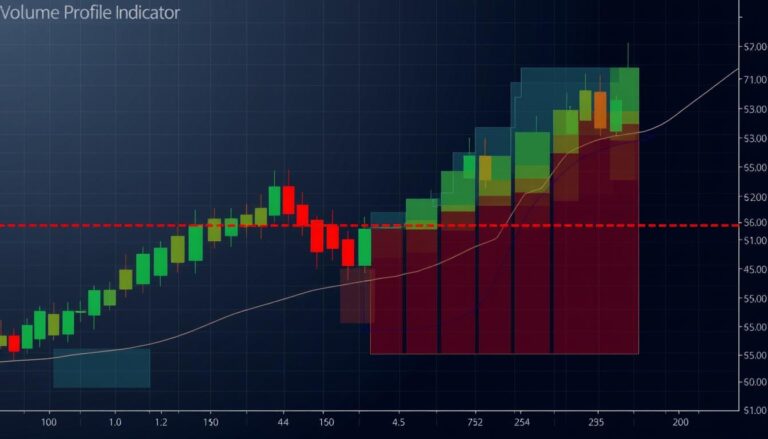

Combining Stochastic Oscillator with Other Indicators

Technical traders often use many indicators to improve their analysis. The stochastic oscillator works better when paired with tools like moving averages and the Relative Strength Index (RSI).

Using moving averages with the stochastic oscillator gives strong trading signals. Traders use these tools together to:

- Confirm trend direction

- Filter possible trade entries

- Validate momentum shifts

Leveraging Moving Averages

Traders can make better strategies by combining stochastic oscillator and moving averages. For example, they might only go long when the price is above a key moving average. Also, the stochastic should show it’s oversold.

RSI and Stochastic Synergy

The Relative Strength Index (RSI) adds to the stochastic oscillator’s momentum insights. When both show the same signals, traders feel more sure about their trades.

- Stochastic RSI readings range between 0 and 1

- Readings below 0.2 mean the market is oversold

- Readings above 0.8 show the market is overbought

Experienced traders say to use these indicators together. They know no single indicator is perfect. The goal is to have a complete strategy that looks at many technical tools.

Common Mistakes to Avoid

Traders often make common mistakes with the Stochastic Oscillator. Knowing these mistakes can help avoid costly errors. It also improves strategy effectiveness.

Misinterpreting Overbought and Oversold Levels

One big mistake is misreading overbought and oversold signals. Traders often see levels above 80 or below 20 as buy or sell signs. This can be risky.

- In strong markets, the indicator stays in these levels for a long time

- Trading without checking other signs can cause big losses

- It’s important to understand the context of these signals

The Danger of Over-Relying on a Single Indicator

Another big mistake is relying too much on the Stochastic Oscillator alone. Good trading needs a mix of methods.

- Always use the Stochastic Oscillator with other indicators

- Look at market trends and fundamental analysis too

- See it as part of a bigger trading plan

Experienced traders know no single indicator is perfect. The Stochastic Oscillator is best with other tools. It helps confirm market moves and avoids simple mistakes.

Tips for Effective Use of the Stochastic Oscillator

Learning to use the stochastic oscillator well takes strategy and a deep understanding of the market. Traders can boost their success by using smart strategies. These strategies help make the most of the indicator’s power.

- Choose the right settings for your trading style

- Look for multiple signals to confirm trades

- Know the market’s current state

- Use it with other indicators for better results

Timing Your Trades Strategically

Getting the timing right with the stochastic oscillator is key. Traders should aim for these situations:

- Spot when trends might change

- Wait for clear price action signs

- Watch for crossovers between %K and %D lines

Using Additional Confirmation Measures

Good traders don’t just rely on the stochastic oscillator. They use extra checks to make sure their trades are solid. Adding volume checks, trend line breaks, and signals from other indicators helps confirm trades.

To get the best results, adjust your stochastic oscillator settings for different markets. Day traders might use 9-3-3 settings, while swing traders might prefer 14-3-3. The goal is to stay flexible and keep learning.

The Role of Market Context

Understanding the market context for stochastic oscillator analysis is key for traders. It helps them use technical trading strategies better. The indicator’s power depends on the market and economic conditions.

Traders need to know the stochastic oscillator works differently in various markets. Its trustworthiness changes between ranging and trending markets. So, knowing the market context is vital for correct use.

Importance of Market Trends

Market trends are important for reading stochastic oscillator signals. Traders should keep these points in mind:

- Know the main market trend before trading

- Strong trends can lead to false signals

- Adjust indicator settings for current market conditions

Integrating Fundamental Analysis

Using fundamental analysis with the stochastic oscillator improves trading. It helps understand how economic factors affect prices:

- Look at economic indicators and news

- Link technical signals with fundamental research

- Check oscillator readings against big economic trends

By mixing market context and fundamental analysis, traders can make their strategy stronger. The goal is to see the indicator as part of a bigger trading plan, not just a tool.

Backtesting and Optimizing Your Strategy

Traders want to do well in trading. They know backtesting is key. It lets them check strategies with old market data before using real money.

- Analyze historical price movements

- Test multiple parameter settings

- Evaluate trading signal accuracy

- Assess risk management metrics

Importance of Backtesting

Backtesting gives traders important info. It shows:

- Average return of 0.57% per trade

- Profit factor of 2.2

- Maximum drawdown of 19.8%

Tools for Backtesting

Today’s trading platforms have great backtesting tools. They help traders fine-tune strategies. You can try different settings in various market conditions.

Pro tip: Think about different volatility levels when tweaking your strategy. For calm markets, use 21, 5, 5. But for wild markets, try 5, 3, 3.

Remember to test different timeframes and check signal reliability. Also, don’t fit too closely to past data. Winners keep tweaking their plans based on solid backtesting.

Pros and Cons of the Stochastic Oscillator

The Stochastic Oscillator is a powerful tool for traders. It helps see market momentum and price reversals. Knowing its good and bad points is key for good trading.

The stochastic oscillator has many advantages. It’s a favorite among technical traders. Let’s look at its main benefits and challenges.

Advantages for Traders

- Identifies market turning points with high precision

- Measures momentum in all market conditions

- Is easy to understand and use

- Gives early signals of reversals

- Works well in both trending and range-bound markets

Limitations and Challenges

Even with its strengths, the stochastic oscillator has its downsides. Traders need to know these to use it well.

- Can give false signals in strong trends

- Prone to whipsaws in volatile markets

- Can stay overbought or oversold too long

- Not as reliable alone

- Performance varies by market timeframe

Using the Stochastic Oscillator well means combining it with other indicators. Always use multiple confirmation signals to validate trade opportunities.

Conclusion: Mastering the Stochastic Oscillator Indicator

Learning the Stochastic Oscillator takes time and effort. Traders who put in the work can get better at reading the market. They need to practice a lot and keep learning new trading skills.

Good traders see the Stochastic Oscillator as part of a bigger picture. They learn to use it with other tools and adjust their plans as the market changes. Getting good at it takes patience, sharp thinking, and a desire to always improve.

The Path to Expertise

To be great with the Stochastic Oscillator, traders must keep learning and practicing. They study market trends, try out different settings, and manage risks well. Skilled traders look beyond simple signals to find deeper insights.

Continuous Learning and Adaptation

The markets are always changing, and so should trading plans. Traders who keep learning stay ahead. They use the Stochastic Oscillator wisely, combining it with deep market knowledge.