Unlock the Power of MetaTrader 5 ADX Indicator

Trading experts see the metatrader 5 ADX indicator as key. It helps understand market moves. This tool gives traders a clear view of financial markets.

The top ADX indicator for MetaTrader 5 lets traders check trend strength. They can look at stocks, CFDs, forex, and futures. This platform covers many markets.

MetaTrader 5 has 38 technical and 39 graphical indicators. The ADX is a top tool for analysis. It shows trend momentum and direction, helping traders make better choices.

Using the metatrader 5 ADX indicator, traders get deep insights into trends. Its design lets them understand price changes well. This helps them plan their trades.

The ADX’s main job is to measure trend strength and direction. It shows values from 0 to 100. This helps traders see market conditions and find good trading chances.

What is the ADX Indicator?

Traders looking to understand market trends find the Average Directional Index (ADX) very useful. It’s a key tool in their MetaTrader 5 strategy. This indicator shows trend strength without telling the price direction.

The ADX was created by Welles Wilder as a way to measure trend intensity. Learning to use ADX in MetaTrader 5 shows traders its value. It gives important insights into market trends.

Understanding the ADX Components

The ADX indicator has three main lines for trend analysis:

- ADX Line: Shows trend strength

- +DI (Positive Directional Indicator): Tracks up price movements

- -DI (Negative Directional Indicator): Tracks down price movements

How ADX Works in Trading

Using a metatrader ADX strategy means knowing how it measures trend strength. It compares trading ranges over time. This helps traders see:

- If a trend exists

- How strong the trend is

- When a trend might change

Traders often use a 14-period setting to filter out market noise. This gives them clearer signals. The ADX value goes from 0 to 100. Higher values mean stronger trends.

Benefits of Using the ADX Indicator

Traders looking to improve their market analysis can find great benefits in the ADX indicator. This tool gives important insights into market trends, trading strategies, and managing risks.

The ADX indicator helps traders understand market dynamics well. With metatrader 5 adx indicator settings, they can tailor their analysis to fit their trading needs.

Identifying Market Trends

Traders use the ADX to spot strong and weak market trends. Important features include:

- ADX values range from 1 to 100

- Readings above 25 show strong trends

- Values below 20 mean weak or range-bound markets

Enhancing Trading Strategies

The metatrader 5 adx crossover strategy offers many benefits. Experienced traders use the ADX to:

- Check trend strength before trading

- Spot market breakouts

- See momentum changes

Risk Management with ADX

Managing risk is key in trading. The ADX helps reduce losses by:

- Staying out of weak trend trades

- Giving clear trend direction signals

- Stopping unnecessary market entries

By using ADX strategies, traders can improve their market analysis and investment decisions.

Setting Up the ADX Indicator on MetaTrader 5

Traders can add the ADX indicator to MetaTrader 5 easily. Knowing how to download and set up the ADX is key for good trading.

The ADX indicator is already in MetaTrader 5. You don’t need to download it. It’s ready to use right in the platform.

Step-by-Step Installation Guide

- Open MetaTrader 5 platform

- Navigate to Insert > Indicators > Trend

- Select Average Directional Movement Index

- Configure default settings or customize parameters

Adjusting Settings for Optimal Use

Changing the ADX indicator settings is important. The default 14-period setting is good for many. But, you can tweak it for better results:

- For short-term trading: Use 7-9 period settings

- For long-term analysis: Consider 20-25 period configurations

- Experiment with different timeframes to match your strategy

Common Mistakes to Avoid

Be careful when using the ADX indicator. Here are some mistakes to avoid:

- Never rely solely on ADX for trading decisions

- Combine with other technical indicators

- Understand that ADX measures trend strength, not direction

- Practice and backtest before live trading

Using the ADX indicator well takes time and practice. You need to know how it fits into your trading plan.

Understanding ADX Readings

Traders looking to improve their metatrader adx strategy need to understand ADX in MetaTrader 5. The Average Directional Index (ADX) shows how strong a market trend is. It’s key for traders in many financial markets.

The ADX indicator uses a scale from 0 to 100. It gives important info about market movements. Here’s what each part means:

- ADX below 20: Weak or non-trending market

- ADX between 20-40: Developing trend

- ADX above 40: Strong trend

- ADX above 50: Extreme trend momentum

Interpreting ADX Values

When using ADX in MetaTrader 5, watch for trend strength signals. The indicator doesn’t show direction but is key for understanding market momentum.

When to Enter or Exit Trades

Smart traders use ADX readings to make good choices:

- Enter trades when ADX rises above 25, showing trend strength

- Think about exiting when ADX starts falling, meaning momentum is weakening

- Use ADX with directional indicators (+DI and -DI) for a full analysis

Differences Between ADX and Other Indicators

Unlike oscillators like RSI, ADX only looks at trend strength. This makes it a great tool in a metatrader adx strategy. It helps traders tell if a market is trending or ranging.

Combining ADX with Other Indicators

Traders can boost their market analysis by using the ADX indicator with other tools. The metatrader 5 adx crossover strategy helps understand market dynamics better. It also makes trading more precise.

Successful trading needs a layered approach to market understanding. The best ADX indicator for MetaTrader 5 gets even stronger with other technical indicators.

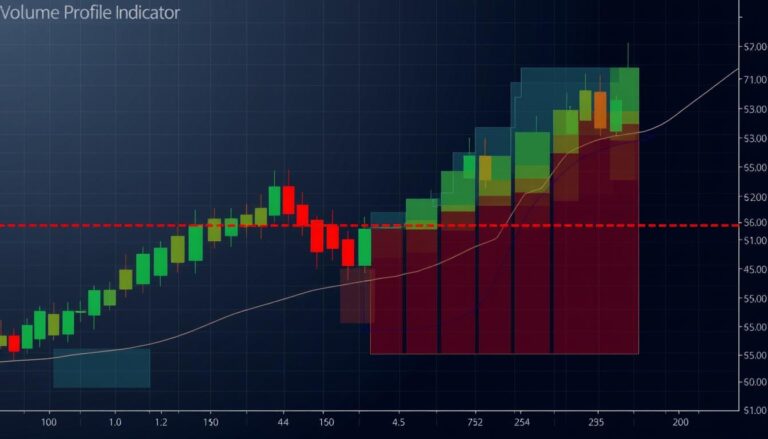

Using ADX with Moving Averages

Moving averages offer key insights when used with ADX. Traders can see trend strength and direction by looking at:

- Price position relative to moving averages

- ADX value confirming trend momentum

- Crossover points between price and moving averages

ADX and Relative Strength Index (RSI)

Using ADX with the Relative Strength Index (RSI) makes analysis strong. This method helps traders:

- Validate trend strength

- Identify possible reversal points

- Assess market momentum

Multi-Indicator Strategies for Success

Creating a solid trading strategy means knowing how indicators work together. Key considerations include:

- Analyzing ADX values across multiple timeframes

- Confirming signals with other indicators

- Adjusting indicator settings for specific market conditions

Remember, no single indicator gives perfect signals. The secret to successful trading is mixing multiple tools for a detailed market view.

ADX Trade Examples

Looking at real trading examples with the ADX indicator helps us learn. It shows how to use it well in MetaTrader 5. This way, traders can make better choices.

To use ADX in MetaTrader 5, we need to see how it works in different markets. Let’s look at some important trade examples:

Real-World Trend Analysis

Traders find good trades by understanding ADX:

- ADX Below 20: Shows a weak market with little trend chance

- ADX Between 20-40: Means a moderate trend, good for careful entry

- ADX Above 40: Points to a strong trend, perfect for bold moves

Practical Trading Scenarios

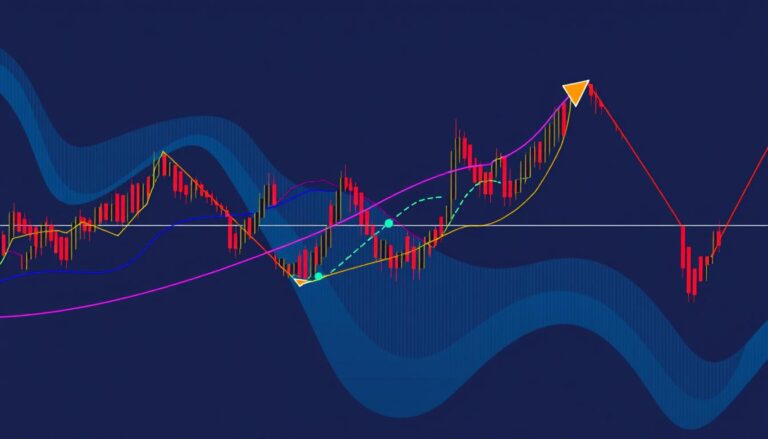

Good traders know how to use ADX in different ways:

- Bullish Trend Confirmation: See +DI go above -DI when ADX is over 25

- Bearish Trend Identification: Watch -DI go above +DI with strong ADX

- Trend Strength Assessment: Keep an eye on ADX to see market strength

Key Lessons from ADX Trading

Important lessons come from using ADX a lot:

- Always check signals with other indicators too

- Remember, markets trend only 30% of the time

- Adjust ADX settings to fit your trading style

Getting good at using ADX takes time, practice, and knowing the market well. Traders who understand ADX signals can make their trading better and more precise.

Tips for Effective ADX Trading

Trading with the MetaTrader 5 ADX indicator needs a smart plan and good understanding. Successful traders know it’s more than just looking at charts. The right ADX indicator for MetaTrader 5 can change your trading game.

Best Practices for New Traders

New traders should build a strong base with the ADX indicator. Here are some important tips:

- Know the trend strength before trading

- Use ADX as a helper, not the only signal

- Practice reading ADX on different timeframes

- Begin with the standard 14-period setting

Common Pitfalls to Avoid

Traders often make big mistakes with the MetaTrader 5 ADX indicator. Stay away from these common mistakes:

- Don’t just rely on ADX without looking at other market signs

- Don’t misread signals in stable markets

- Don’t ignore price movements with ADX readings

- Don’t forget to change settings for different market situations

Continuous Learning and Improvement

Getting good at the ADX indicator is a never-ending journey. Successful traders always study market trends. Try different timeframes, see how ADX works in various markets, and keep improving your strategy.

Remember, the best ADX indicator for MetaTrader 5 is one you really get and use with confidence. Keep practicing and learning to become a skilled trader.

Customizing ADX to Fit Your Needs

Traders know that one way doesn’t fit all markets. The ADX indicator in MetaTrader 5 is very flexible. It can be customized to fit your trading style and the market.

When setting up the metatrader 5 adx indicator, you can make it work for different trading places. The trick is knowing how to change it for the best results.

Modifying Settings for Different Markets

Each market needs a special way to use the ADX indicator. Here are some smart changes:

- Short-term trading: Use 7-9 period settings for volatile markets

- Long-term investing: Implement 21-28 period settings for stable markets

- Cryptocurrency trading: Adjust sensitivity for rapid market changes

Using Alerts and Notifications

MetaTrader 5 ADX alert systems give traders important market info. By setting up metatrader 5 adx alert settings, you can get instant alerts about trading chances.

Tailoring ADX for Scalping and Day Trading

Scalpers and day traders need precise ADX settings. Short time frames and quick alerts help make fast decisions in fast markets.

- Set up custom alert thresholds

- Create multiple indicator overlays

- Use color-coded visual indicators

Successful traders always try new ADX settings. They know that being able to adapt to the market is key to doing well.

Technical Analysis with ADX

Traders can use the Average Directional Index (ADX) to improve their market analysis. Learning how to use ADX in MetaTrader 5 can make trading strategies better. It helps in making quick and smart decisions.

The ADX indicator shows the strength of market trends. It’s key for detailed technical analysis. Traders can create a strong ADX strategy by knowing the basics and how to apply it.

Integrating ADX into Technical Analysis

Good technical analysis needs many confirmation signs. The ADX shows trend strength by looking at market momentum. It helps traders:

- Check trend strength

- See possible price changes

- Spot market shifts

- Work with other technical tools

Chart Patterns to Consider

When using a MetaTrader ADX strategy, some chart patterns are more important. Traders should look at:

- Triangle Formations: Check trend strength before a breakout

- Channel Patterns: See if a trend will keep going or change

- Head and Shoulders: Check if a trend will change

Timing Your Trades with ADX Signals

Getting the timing right is key in technical analysis. The ADX indicator shows when to enter and leave trades. A reading over 25 means a strong trend, which is good for trading.

Traders can make their MetaTrader ADX strategy better by understanding these signals. They should also use other technical tools.

Exploring ADX Limitations

The metatrader 5 adx indicator is a strong tool for trading. But, knowing its limits is key for good trading plans. No single tool can give perfect market insights, and the ADX is no different.

Traders using the best adx indicator for metatrader 5 need to know when it might not work:

- Choppy or Ranging Markets: ADX struggles to provide reliable signals in markets without clear directional momentum

- Low Volatility Conditions: Trend strength indicators become less effective during periods of minimal price movement

- Sudden Market News Events: Unpredictable price shifts can render ADX readings temporarily irrelevant

Scenarios Where ADX May Fail

Traders must know the ADX indicator works best in trending markets. When markets lack clear direction, the indicator can give wrong signals. This might lead to bad trading choices.

Balancing ADX with Other Tools

To deal with its limits, traders should:

- Combine ADX with other technical indicators

- Use fundamental analysis alongside technical signals

- Implement robust risk management strategies

Knowing When Not to Rely on ADX

Professional traders know no single indicator can predict market movements with absolute certainty. The ADX should be seen as part of a full trading plan. It’s not a perfect forecasting tool.

Community Insights and Strategies

Trading with the ADX indicator gets better when you learn from others. The MetaTrader ADX strategy community shares valuable tips. These tips can make your trading better.

Traders on MetaTrader 5 have found smart ways to use the ADX indicator. They’ve noticed some trends in their strategies:

- 66.7% of traders prefer MetaTrader 5 for advanced ADX strategies

- Top complementary indicators include:

- Fibonacci levels

- Moving Averages

- MACD

- RSI

Learning from Experienced Traders

Experienced traders share detailed ways to use ADX in MetaTrader 5. They say using many indicators together is key. The Catalyst Trend indicator is a great example of this.

Participating in Online Forums

Online forums are great for sharing MetaTrader ADX strategies. Traders talk about advanced methods like the Alpine Predictive Bands indicator. It uses ADX and market conditions to predict trends.

Sharing Your Own ADX Experiences

Your trading story helps the community grow. By sharing your ADX strategy experiences, you help others. You also gain more market insights.

Conclusion: Maximizing Your Trading Potential

The MetaTrader 5 ADX indicator is a powerful tool for traders. It helps them understand complex market conditions. To master it, traders need to practice and use it wisely.

Traders should see the ADX as part of a bigger strategy. Using it with other indicators and managing risks well makes it more effective. This way, traders can get the most out of the MetaTrader 5 ADX indicator.

Key Takeaways for Traders

Technical analysis keeps changing, and traders must stay flexible. The ADX indicator shows trend strength, which is very useful. When used with other tools, it gives even more insights.

Traders should keep learning and testing their strategies. Staying up-to-date with market changes helps them use technical analysis to its fullest.

Looking Ahead in Trading Technology

Future trading platforms might use advanced algorithms with indicators like ADX. Machine learning and artificial intelligence could change how we analyze trends. Staying updated with technology and knowing technical analysis well is key for success.